GS 3 – ECONOMY

Context:

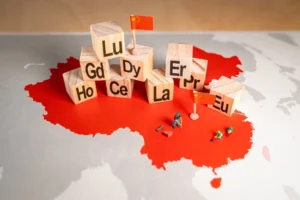

China has tightened controls over rare earth elements (REEs), consolidating its position as the largest global producer (60%+ share). New rules by China’s Ministry of Industry and Information Technology seek to:

- Centralize oversight of extraction, refining, and exports.

- Control supply chains of critical minerals essential for clean energy, defense, and tech sectors.

WHY IT MATTERS

| Dimension | Relevance |

| Strategic | REEs are crucial for missiles, semiconductors, EVs, wind turbines, solar panels, and defense |

| Geopolitical | US, India, Japan, and EU depend on China’s REEs → Risk of strategic blackmail |

| Economic | Supply chain disruptions → impacts clean energy transition + industrial manufacturing |

| Scientific | REEs are difficult and expensive to mine + process → High environmental cost |

What Are Rare Earth Elements (REEs)?

- Not rare by occurrence, but rarely found in concentrated deposits → costly to mine and refine.

- 17 elements divided into:

- Light REEs: Lanthanum, Cerium, Neodymium, Praseodymium, etc.

- Heavy REEs: Gadolinium, Dysprosium, Terbium, etc.

Key Data & Charts

- Production Dominance:

- China: ~63% of global rare earths mined

- Controls ~60% of global exports

- Chart 1: China has 48.1% of total reserves

- Export & Processing Power:

- Chart 3: China = Top global exporter (~55% in 2024)

- Chart 4: Sectors affected: Magnets, Displays, Ceramics, Optics, Aerospace

- Top Importers of China’s REEs:

- Japan (top), followed by USA and The Netherlands