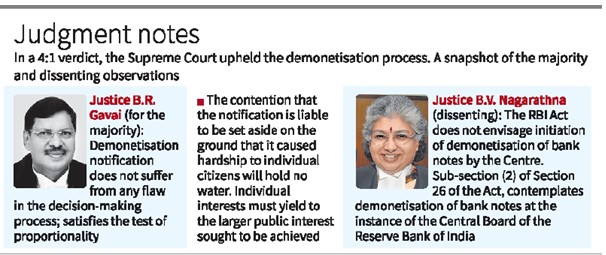

- A majority of four judges on a Constitution Bench of the Supreme Court on Monday found no flaw in the Union government’s process to demonetise ₹500 and ₹1,000 banknotes through a Gazette notification issued on November 8, 2016.

- The sole woman judge on the five-member Bench, Justice B.V. Nagarathna, however, disagreed with the majority, saying the government’s notification issued under Section 26(2) of the Reserve Bank of India (RBI) Act was unlawful.

- Justice B.R. Gavai, delivering the judgment for the majority, which included Justices S. Abdul Nazeer, A.S. Bopanna, and V. Ramasubramanian, pronounced that the statutory procedure under Section 26(2) was not violated merely because the Centre had taken the initiative to “advise” the Central Board to consider recommending demonetisation.

- Differing, Justice Nagarathna said the Centre could have issued a notification under Section 26(2) only if the Central Board of the RBI had initiated the proposal to demonetise a specified series of banknotes by way of a recommendation. Here, in 2016, the government had initiated the demonetisation, not the Central Board.

- In cases in which the government initiates demonetisation, Justice Nagarathna said, it should take the opinion of the Central Board. The opinion of the Board should be “independent and frank”.

- If the Board’s opinion was in the negative, the Centre could still go forward with the demonetisation exercise, but only by promulgating an ordinance or by enacting parliamentary legislation.

SC finds no flaw in 2016 demonetisation process

- Describing Parliament as the “nation in miniature”, she said, “Without Parliament, democracy will not thrive.”

- Justice Nagarathna further concluded there was no “meaningful application of mind” by the Central Board to the government’s initiative for withdrawing ₹500 and ₹1,000 notes, which formed 86% of the currency in circulation at the time, causing severe financial crunch and socio-economic despair.

- She said the Central Board had “hardly 24 hours to consider the proposal” of the Centre to demonetise the notes. The objectives of demonetisation were “noble and well-intentioned”, but the process undertaken was bad in law, she added. Nothing, however, can be done to restore the situation to status quo ante, but the judgment could act prospectively, she said.

- Official records show the Central Board acted merely on “assurances” given by the government that “embarking on the process of demonetisation would result in reducing banknotes in the economy and a switch over to the digitalisation of the economy”, Justice Nagarathna observed.

- The petitioners, led by senior advocate P. Chidambaram, had contended that the decision-making process was “rushed” and “fatally flawed”.

- Justice Gavai, however, said the RBI and the Centre had been in consultation with each other for six months prior to the November 8 notification issued under Section 26(2) of the RBI Act.

- Meanwhile, Justice Gavai rubbished the petitioners’ argument that a hasty decision was taken to demonetise, noting that “such measures undisputedly are required to be taken with utmost confidentiality and speed.

- If the news of such a measure is leaked out, it is difficult to imagine how disastrous the consequences would be”.

- Justice Gavai said demonetisation was done for the “proper purposes” of eliminating fake currency, black money and terror financing. He said there was a “reasonable nexus” between the measure of demonetisation and its objectives.

- “The Central government is the best judge since it has all the inputs with regard to fake currency, black money, terror financing and drug trafficking.

- As such, what measure is required to be taken to curb the menaces would be best left to the discretion of the government in consultation with the RBI,” the majority opinion said.

- Arguments that demonetisation violated citizens’ right to property by taking away their money were “without substance”, it said.

- There were reasonable restrictions to the right. Unlike the demonetisation of 1978, when only five days were given to exchange old notes for new, the 2016 demonetisation gave 52 days. On whether demonetisation met its desired objectives was best left to the government, they said.

SOURCE: THE HINDU, THE ECONOMIC TIMES, PIB

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs