PRELIMS BITS

Indian States are increasingly dependent on financial transfers and grants from the Central government, raising concerns about fiscal sustainability and independent revenue generation.

Key Trends in Revenue Dependency:

- Rise in Central Transfers:

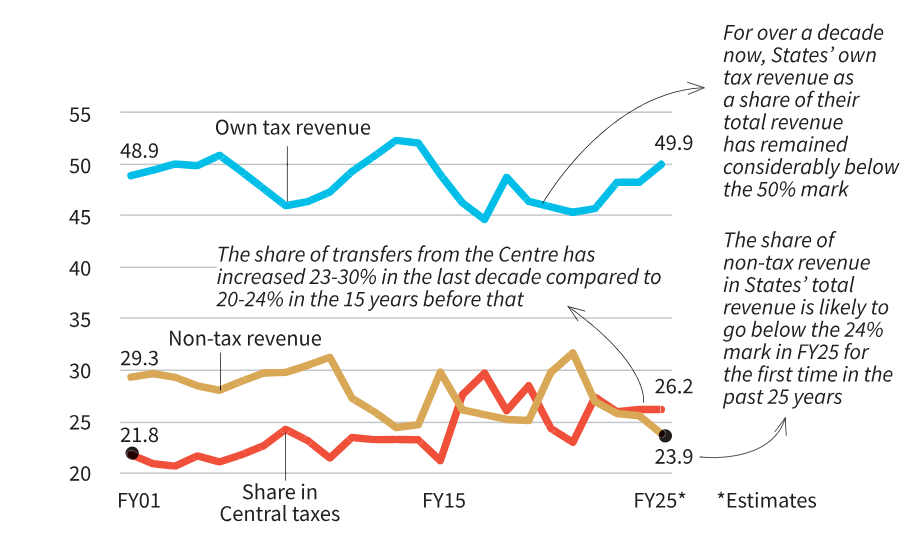

- Central transfers accounted for 23-30% of State revenues between FY16 and FY25, up from 20-24% in the 2000s and early 2010s.

- Decline in Own Tax Revenue:

- States’ own tax revenue has stayed below 50% of total revenue for over a decade, compared to the 2000s when it often exceeded this level.

- Non-Tax Revenue Decline:

- Non-tax revenue is projected to fall below 24% in FY25, the lowest in 25 years. Central grants now make up 65-70% of non-tax revenue, compared to 55-65% previously.

- Impact of SGST:

- The State Goods and Services Tax (SGST) increased from 15% of total revenue in FY18 to 22%, but own tax revenue excluding SGST fell from 34% to 28%.

Challenges and Concerns:

- Tax Collection Issues: Inefficient tax collection limits revenue potential. Sporadic efforts to mobilize taxes through stamp duty and vehicle taxes remain inadequate.

- Declining Tax-to-GSDP Ratio: States like Tamil Nadu and Kerala have seen declines, while others remain stagnant.

Implications for Fiscal Sustainability:

Stagnant tax revenue restricts States’ ability to implement fiscal measures, potentially hampering economic growth and reducing demand. Increased reliance on Central transfers underscores the need for improved revenue generation strategies at the State level.