- The Finance Commission is a quasi-judicial body established by Article 280 of the Indian Constitution.

- Every five years or earlier if deemed necessary, it is established by the President of India.

- The Parliament determines the qualifications of the members of the Commission and their selection methods.

- Their recommendation is not binding

Chairman: Serves as the head of the Commission and oversees its operations. He needs to have prior expertise in public affairs.

- The chairman of the commission is chosen from among people who have or have had experience in public affairs, in accordance with the provisions of the Finance Commission (Miscellaneous Provisions) Act, 1951, and The Finance Commission (Salaries & Allowances) Rules, 1951.

The other four members are chosen from among people who:

(a) are, or have been, qualified to be appointed as judges of a High Court;

(b) have sound knowledge of the finances and accounts of government;

(c) have had wide experience in financial matters and in administration; or

(d) have had specialised knowledge of economics.

ROLE

Vertical devolution

- refers to the allocation of central taxes across states.

Horizontal distribution

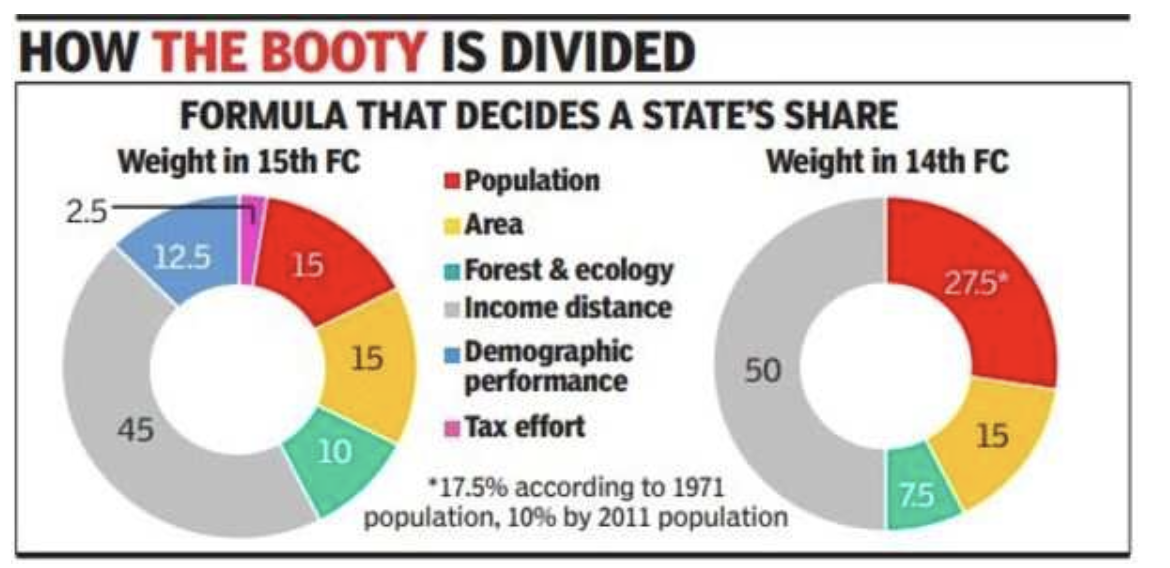

- Horizontal distribution involves allocating resources among states based on a formula that considers their fiscal needs, capacities, and performance.

- Grants-in-aid provide additional funding to states or sectors in need of assistance or reform.

The Finance Commission shall make recommendations on the following matters:

- proceeds of taxes which are to be, or may be, divided between them under Chapter I, Part XII of the Constitution and the allocation between the distribution between the Union and the States of the net the States of the respective shares of such proceeds;

- The principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India and the sums to be paid to the States by way of grants-in-aid of their revenues under article 275 of the Constitution for the purposes other than those specified in the provisos to clause (1) of that article; and

- The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the State on the basis of the recommendations made by the Finance Commission of the State.

- Any other matter related to it by the president in the interest of sound finance.

ISSUES IN FC

- Data Gaps and Quality Issues: FCs rely on official data sources to evaluate the Union’s and the states’ fiscal performance, but these sources’ data are frequently inaccurate, inconsistent, or out-of-date.

- For example, trustworthy data on interstate commerce flows, public service unit costs, or the results of various initiatives and programmes are lacking.

- Political economy factors: FCs must strike a balance between the conflicting demands and interests of a range of stakeholders, including the federal government, state governments, local governments, and civil society organisations.

- They also need to consider how the global and national political and economic situations are evolving.

- Implementation Challenges: FCs must make sure that their suggestions are workable, acceptable, and efficient in reaching the intended goals.

- Nevertheless, they have no control over how the federal government and state governments carry out or oversee their recommendations.

- In addition, they must handle problems like delays, deviations, non-compliance, or recipient misappropriation of funds.

- Evaluation Challenges: Financial Commissioners (FCs) must evaluate the effects and results of their recommendations on a range of fiscal health, governance, and development performance indicators.

WAY FORWARD

- Improving Fiscal Autonomy and Equity: Based on their respective constitutional obligations and spending requirements, FCs must strive to supply the Union and state governments with sufficient and predictable resources.

- In addition, they ought to provide an equitable and transparent allocation of resources among the states, considering their financial capabilities, achievements, and unique situations.

- Encouraging the Union and state governments to implement sound fiscal policies and practices, such as fiscal consolidation, debt sustainability, revenue mobilisation, rationalisation of expenditures, etc., is something that FCs should undertake to promote fiscal efficiency and accountability.

- Additionally, they ought to provide incentives for them to raise the quality and efficiency of public spending, particularly in high-priority areas like infrastructure, education, health, and so on.

- Management of Emerging Issues and Challenges: Finance commission (FCs) should to be proactive in responding to the global and national shifts in the economic and social landscape.

- They ought to investigate fresh approaches and methods for strengthening the nation’s competitive and cooperative federalism.

- Enhancing Institutional Credibility and Capacity: (FCs) need to enhance their analytical and advising capacities through the utilisation of dependable and current data sources, the use of strong and inventive techniques, the interaction with specialists and stakeholders, etc.

- Additionally, they should improve their outreach and communication tactics by publicly sharing their findings and recommendations, asking for comments and suggestions, raising awareness and reaching an agreement among different actors, etc.

Pradhan Mantri Suryodaya Yojana

- PM chairs a meeting to launch “Pradhan Mantri Suryodaya Yojana” with the target of installing rooftop solar on 1 crore houses

- Scheme aims to reduce the electricity bill of the poor and middle class, along with making India self-reliant in the energy sector

- PM directs to start a massive national campaign to mobilize residential segment consumers to adopt rooftop solar in large numbers

- During the meeting, the Prime Minister said that the power of the sun can be harnessed by every household with a roof to reduce their electricity bills and to make them truly aatmanirbhar for their electricity needs.

- Pradhanmantri Suryodaya Yojana aims to provide electricity to low and middle-income individuals through solar rooftop installations, along with offering additional income for surplus electricity generation.

Srimanta Sankardev

- During the 15th and 16th centuries, Srimanta Sankardev, an Assamese polymath, was a prominent person in the cultural and religious history of Assam, India. He was a poet, playwright, dancer, actor, musician, artist, and social-religious reformer.

- He is most known for inventing new genres of dance (Sattriya), music (Borgeet), theatre (Ankia Naat, Bhaona), and literary language (Brajavali).

- He also left behind a vast body of writing in Sanskrit, Assamese, and Brajavali, including poetry, theological essays, and trans-created scriptures.

- Ekasarana Dharma, the religious movement created by Bhagavata, is popularly referred to as the Neo-Vaishnavite movement.

- As throughout the Indian subcontinent, the Bhakti movement in Assam was inspired by Sankardev in the same manner as it was by Guru Nanak, Ramananda, Namdev, Kabir, Basava, and Chaitanya Mahaprabhu.

- The late 18th-century Matak Kingdom, founded by Bharat Singha and strengthened by Sarbananda Singha, endorsed his ideals.

Literary compositions

- ‘Kirtana Ghosha,’ ‘Gunamala,’ and other works are among his famous literary creations.

- They call his sacred songs ‘Borgeet.’

- The Satria dance was a highlight of his plays at the time they were known as “Ankia Naat.”

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs