AI chatbots’ advancement in India’s banking sector

The Reserve Bank of India (RBI) published its 2022–2023 report on the trends and advancements in Indian banking. It examines the application of artificial intelligence (AI) in banks and how it has developed over time.

About 80% of banks in India have adopted chatbots capable of engaging in conversations with human users

- Between 2015–16 and 2021–22, RBI staff members conducted an analytical study on banks’ annual reports to determine the level of awareness and readiness for adopting AI in Indian banks.

Using named entity recognition techniques and domain-specific keyword matching, this study used a textual analysis method.

- It made use of well-known machine learning (ML) and artificial intelligence (AI) dictionaries and glossaries

- from organisations like the Council of Europe, IBM, Google Developers, Google Vertex AI, and NHS AI Lab.

- Insights from large language models, like Bard and ChatGPT, were also incorporated into the analysis.

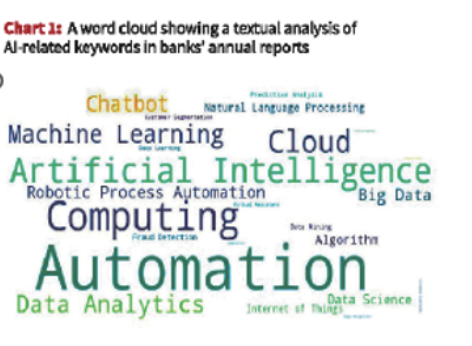

Chart 1:

A word cloud analysis reveals that banks place a lot of emphasis on automation. According to the RBI study, this trend most likely results from the desire to increase effectiveness and capabilities in fraud detection and other predictive analytics applications. Notable is also the awareness of, or potential for, implementing cutting-edge technologies like Internet of Things, Natural Language Processing, and Robotic Process Automation.

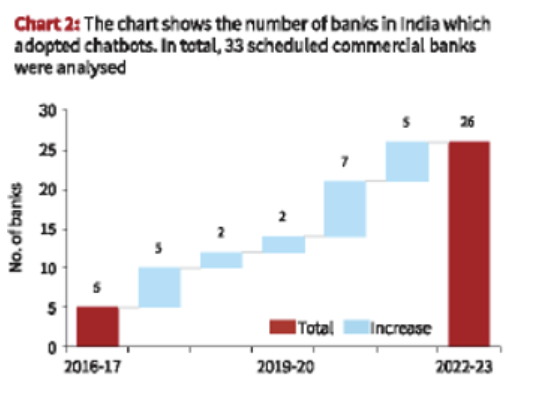

Chart 2

Chatbots, which can converse with human users in natural languages via text or

voice, are a major application of artificial intelligence (AI) in a variety of service sectors. The number of Indian banks using chatbots is displayed in this chart. Just five banks had chosen this facility as of FY17. This increased little by little over the ensuing years. Currently, 26 banks offer this service.

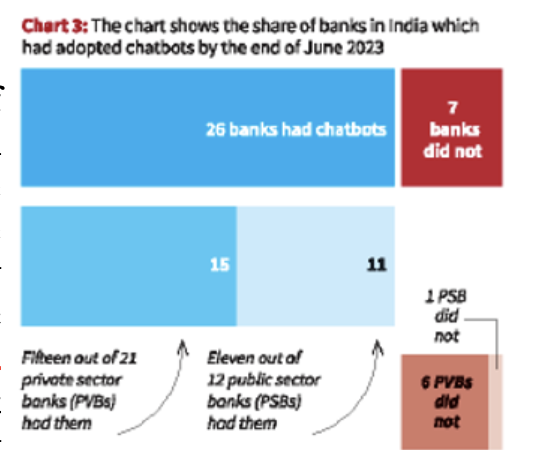

Chart 3

The percentage of Indian banks that have implemented chatbots is displayed in this Chart. 2

6 out of the 33 scheduled commercial banks that were examined, or more than 78.8% of the banks, have emb

raced this service. The study found that 11 of the 12 public sector banks (PSBs) used AI and ML

technologies to implement chatbots and virtual assistants by the end of June 2023. On the other hand, only 15 out of 21 private sector banks (PVBs) had them.

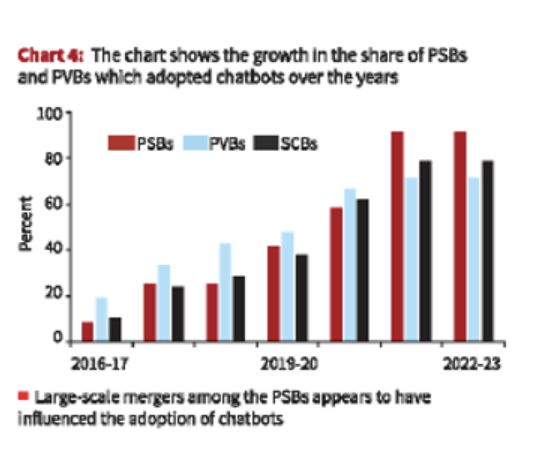

Chart 4

The percentage of PSBs and PVBs that have embraced chatbots has increased over time, as seen in this Chart. In FY17, the percentage of PVBs using chatbots was noticeably higher than the percentage of PSBs. The adoption of chatbots appears to have been influenced by the trend of large-scale PSB mergers, as merged entities frequently adopt technology from the banks they acquire.

- However, in the years that followed, the situation reversed. The RBI study claims that non-banking financial companies have also begun implementing chatbotsfor customer support.

Artificial Intelligence (AI) tools are widely embraced and extensively employed in domains like digital marketing, fraud detection, and information technology operations optimisation. The study makes the case that by utilising these applications, banks can increase productivity and enhance customer satisfaction. The assessment of default risks is improved when machine learning techniques are applied to real-time customer transaction analysis. The study indicates that this strengthens their risk management techniques.

But the study also concludes with a warning.

- AI in finance has the potential to increase already-existing risks and create new ones, like worries about consumer protection.

- The opaque operation of AI models makes it more difficult for financial firms to comply with legal requirements and internal controls.

- The study cautions that these models may cause market shocks and increase systemic risks, especially with regard to procyclicality.

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs