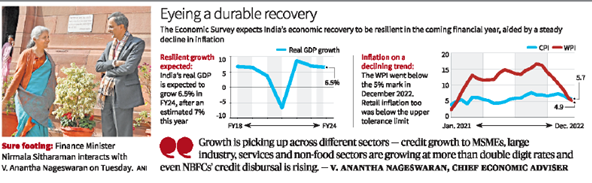

- Painting an exuberant picture of the Indian economy’s prospects thanks to “New Age” reforms undertaken since 2014, the Economic Survey tabled by Finance Minister Nirmala Sitharaman in Parliament on Tuesday asserted that not only were the pandemic-induced blues over, but the outlook for the years ahead was also rosier than in the pre-COVID years.

- Though global uncertainties are rife and the world economy is slowing, the Survey exuded confidence that India’s GDP would grow 6.5% in 2023-24, after an estimated 7% this year, “supported by solid domestic demand and a pickup in capital investment”.

- “The Indian economy in 2022-23 has nearly ‘recouped’ what was lost, ‘renewed’ what had paused, and ‘re-energised’ what had slowed during the pandemic and since the conflict in Europe,” the Survey averred.

Uncertain times

- The final growth outcome for 2023-24 could be in the range of 6% to 6.8%, depending on the trajectory of global economic and political developments.

- “Some of you may think the range is asymmetric in nature, but that is deliberate because there is still uncertainty. We have many known unknowns and unknown unknowns,” remarked Chief Economic Adviser (CEA) V. Anantha Nageswaran.

- While the Survey expects inflation — a bugbear for the economy throughout this year — to be “well-behaved” in 2023-24, the CEA acknowledged there were upside risks to commodity prices from external factors such as China rapidly restarting economic activity.

‘Inflation no deterrent’

- The central bank’s estimate of 6.8% retail inflation for 2022-23 is outside its target range, but “at the same time, it is not high enough to deter private consumption and also not so low as to weaken the inducement to invest,” the Survey said.

- “We expect [that] if the global economy slows down as the IMF and many people project, then commodity prices should retreat on the back of the monetary tightening…

- As of now, the United States economy looks set to avoid a full-fledged formal recession. And therefore, this January, already we have seen crude oil prices and industrial metal prices are higher than they were at the end of December,” the CEA noted.

Economy to grow 6.5% in 2023-24

- Monetary and fiscal authorities will need to stay proactive and vigilant on inflation as well as the worsening current account deficit front, the Survey noted, flagging multiple risks for the latter, including slowing exports, a rising import bill due to strong domestic demand and commodity prices still being above pre-conflict levels, referring to the Russia-Ukraine war.

- “Should the current account deficit widen further, the currency may come under depreciation pressure,” it said.

- Entrenched inflation may prolong the monetary tightening cycle and keep borrowing costs “higher for longer”, the Survey admitted, but even a low global growth scenario will present two silver linings for India – low oil prices and a better current account deficit situation.

- “Noting that ‘successive shocks’ over recent years, such as the ILFS collapse, the COVID-19 pandemic and the supply chain shocks in 2022, have led to a lag in the growth effects of sweeping reforms across multiple dimensions carried out between 2014 and 2022,” the CEA said.

- He compared this to the lag effects seen on growth post-2003, from reforms carried out by the Atal Bihari Vajpayee-led government between 1998 and 2002.

- Stressing that India is prepared to “grow at its potential once the one-off shocks recede’”, the Survey said that the financial cycle was poised to turn upward after a long period of balance sheet repair in the financial and corporate sector.

- Over the medium term, the Survey suggests that the growth rate could be around 6.5%, with a potential to go up to 7% and 8%, subject to macroeconomic stabilisation, restoring fiscal consolidation and continuing the thrust on infrastructure building as well as reforms such as encouraging women’s employment and dismantling what Mr. Nageswaran termed ‘LIC (License, Inspection and Compliance)’ regimes across Central, State and local government levels.

- Even without export growth kicking in, we can strive for and be able to achieve 8% growth, if on top of the reforms already done, several other additional dimensions are addressed as well.

- But the reason we shouldn’t be looking at 8% or 9% growth at this point is the difference from the first decade of the millennium, when the global economy was booming. Now it is not, in spite of the aggressive unconventional monetary easing in the developed world,” the CEA pointed out.

- To a query on whether the reforms and “successive shocks” to the economy referred to by the Survey, included the impact of demonetisation on the informal sector in November 2016, he said there were academic studies that showed that the impact of the note ban, if any, was ‘fleeting’.

SOURCE: THE HINDU, THE ECONOMIC TIMES, PIB

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs