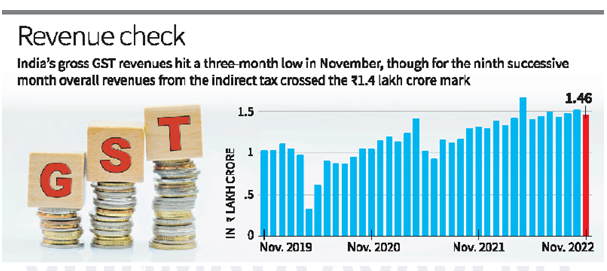

- India’s gross GST revenues were ₹1,45,867 crore in November 2022, 11% higher than a year ago, but nearly 4% below October’s kitty. Revenues from import of goods were 20% higher while domestic transactions, including import of services, yielded 8% higher taxes than November 2021.

- State GST collections in November accounted for ₹32,651 crore of revenues, while the Integrated GST kitty was ₹77,103 crore, including ₹38,635 crore collected on import of goods.

Compensation cess

- GST Compensation Cess collections were at ₹10,433 crore, factoring in ₹817 crore collected on import of goods — marginally lower than the ₹10,505 crore collected in October 2022.

- While November’s GST inflows, based on transactions undertaken in October, mark a three-month low, this is the ninth successive month that overall revenues from the indirect tax are over the ₹1.40 lakh crore mark.

- “The government has settled ₹33,997 crore to CGST and ₹28,538 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States after regular settlements in the month of November 2022 is ₹59,678 crore for CGST and ₹61,189 crore for the SGST,” the Finance Ministry said in a statement.

- Last week, the Centre had released ₹17,000 crore as GST compensation dues to States.

- As many as six States recorded a contraction in revenues in November, including Gujarat, Rajasthan and Kerala (-2%), Punjab (-10%), Himachal Pradesh (-12%) and Goa (-14%).

SOURCE: THE HINDU, THE ECONOMIC TIMES, PIB

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs