Introduction

Microfinance is a method of lending very small sums to individuals to start or expand a small business. These borrowers tend to be low-income individuals.

Features of Microfinance in India

- The principal amount borrowed is less than Rs 1 lakh

- Interest rates are lower than normal banks

- Does not require collateral for loan

- Issued to households with an annual income of up to Rs 3 lakh.

Micro Finance Institution- MFI

Microfinance Institutions are financial institutions that offer small loans to borrowers without access to banking services. Their services include microloans, micro savings, microinsurance, etc.

Objectives of Microfinance Institutions

- Offers support to the lower strata of society.

- Encourage rural entrepreneurship and self-employment generation

- Adopting an effective strategy to help eradicate poverty

- Ensure financial inclusion and accelerate the development process

- Improvise the skill set among rural people

Types of Microfinance Institutions

- Joint Liability Group (JLL)

- Self-Help Group (SHG)

- Regional Rural Bank

- Cooperatives

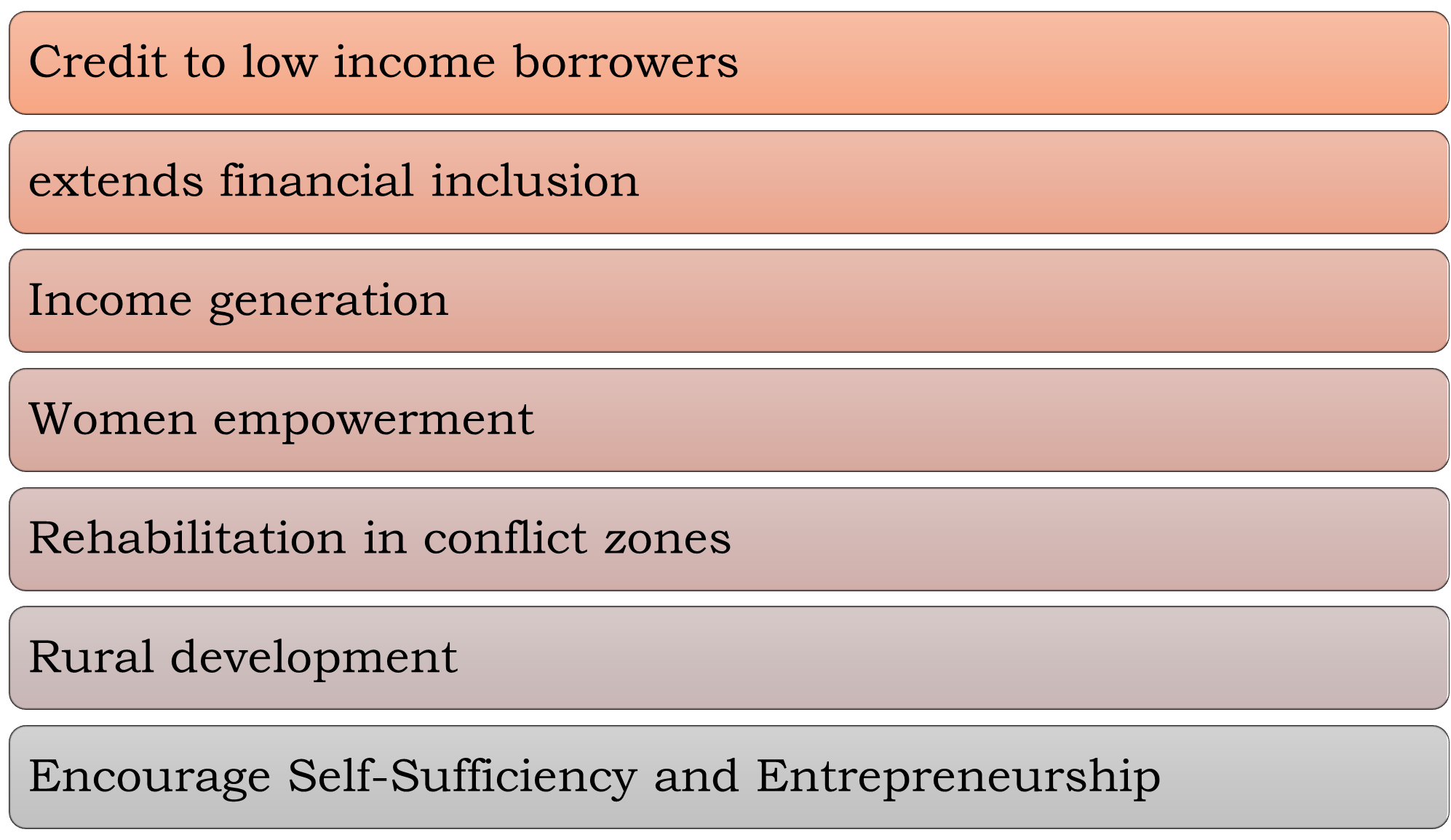

Benefits of Microfinance

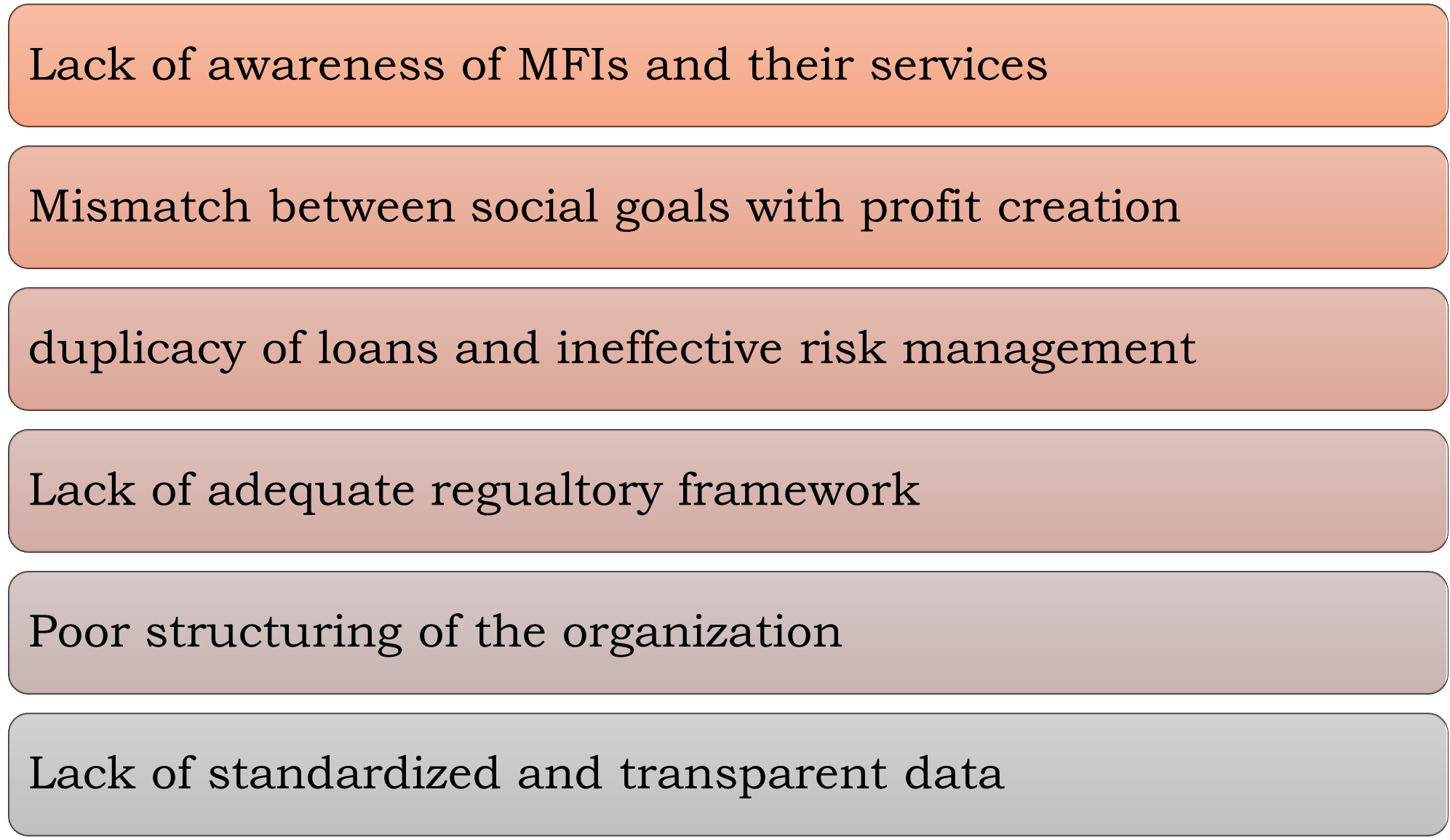

Challenges Faced

Initiatives undertaken

Government Programmes

- SHG-Bank Linkage Programme (SHG-BLP)

- Initiated by NABARD in 1992, this model especially incentivises women’s self-help group to unite mobilize resources to avail loans and other banking services.

- Micro Enterprise Development Programme (MEDPs) & Livelihood and Enterprise Development Programme (LEDP)

- The programme enables SHG members to be up-skilled to take up income generating livelihood activities.

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- It implements the credit guarantee scheme for Micro and Small Enterprises which is extended to microfinance institutions as well.

- Financial Support by NABARD and SIDBI

- NABARD provides Revolving Fund Assistance (RFA) while SIDBI aids through SIDBI Foundation for Micro Credit (SFMC), India Microfinance Equity Fund (IMEF)

- Micro Units Development & Refinance Agency Ltd (MUDRA)

- Support to Microfinance sector was scaled up by Government of India by setting up MUDRA in 2015.

Regulatory Initiatives

- Y H Malegam Committee

- In the wake of AP Microfinance crisis in 2010, it was constituted by the RBI to study issues and concerns in the Microfinance sector

- Introduction of Regulations for NBFC-MFIs

- A comprehensive regulatory framework including eligibility criteria for loans for NBFC-MFIs was introduced in 2011 based on the Malegam Committee recommendations.

- Regulatory Framework for Microfinance Loans

- RBI has implemented Regulatory Framework for Microfinance Loans, effective from April 1, 2022, to update Microfinance regulatory policy.

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs