Alternative Investment Funds (AIFs) are privately pooled investment vehicles in India that collect funds from sophisticated investors for investing in accordance with a defined investment policy. They are regulated by the Securities and Exchange Board of India (SEBI) under the SEBI (Alternative Investment Funds) Regulations, 2012.

Why in NEWS

To prevent banks and finance companies from artificially extending bad loans (“evergreening”), RBI imposed stricter rules on their investments in Alternative Investment funds (AIFs).

Key features of Alternative Investment Funds (AIFs)

1. Private pooled investment vehicles: Unlike mutual funds, AIFs aren’t open to the public. They cater to a restricted pool of qualified investors, typically with a high net worth or significant investment experience.

2. Investment in alternative assets: AIFs venture beyond traditional assets like stocks and bonds. They can invest in a wider range

- Private equity: Financing privately held companies with high growth potential.

- Venture capital: Funding early-stage, high-risk startups with the potential for explosive growth.

- Hedge funds: Employing complex investment strategies to generate returns regardless of market conditions.

- Real estate: Investing in properties like residential buildings, commercial spaces, or land for development.

- Infrastructure: Investing in projects like roads, bridges, power plants, or airports.

- Debt: Investing in corporate bonds, government bonds, or other debt instruments.

3. Flexible investment strategies: AIFs have more freedom in their investment approaches compared to traditional funds. They can utilize:

- Leverage: Borrowing money to amplify potential returns, but also magnify losses.

- Short selling: Selling borrowed assets with the expectation of repurchasing them at a lower price later for profit.

- Derivatives: Complex financial instruments used to hedge risk or speculate on price movements.

4. Higher potential returns: Due to their exposure to alternative assets and flexible strategies, AIFs offer the possibility of higher returns than traditional funds.

5. Higher risks: AIFs generally involve greater risk due to:

- Less regulation: Compared to traditional funds, AIFs face less stringent regulations, potentially increasing exposure to risk.

- Illiquidity: Some AIF investments, like private equity or real estate, might be difficult to sell quickly, making them illiquid.

- Complex strategies: The intricate investment approaches employed by some AIFs can be challenging to understand and carry inherent risks.

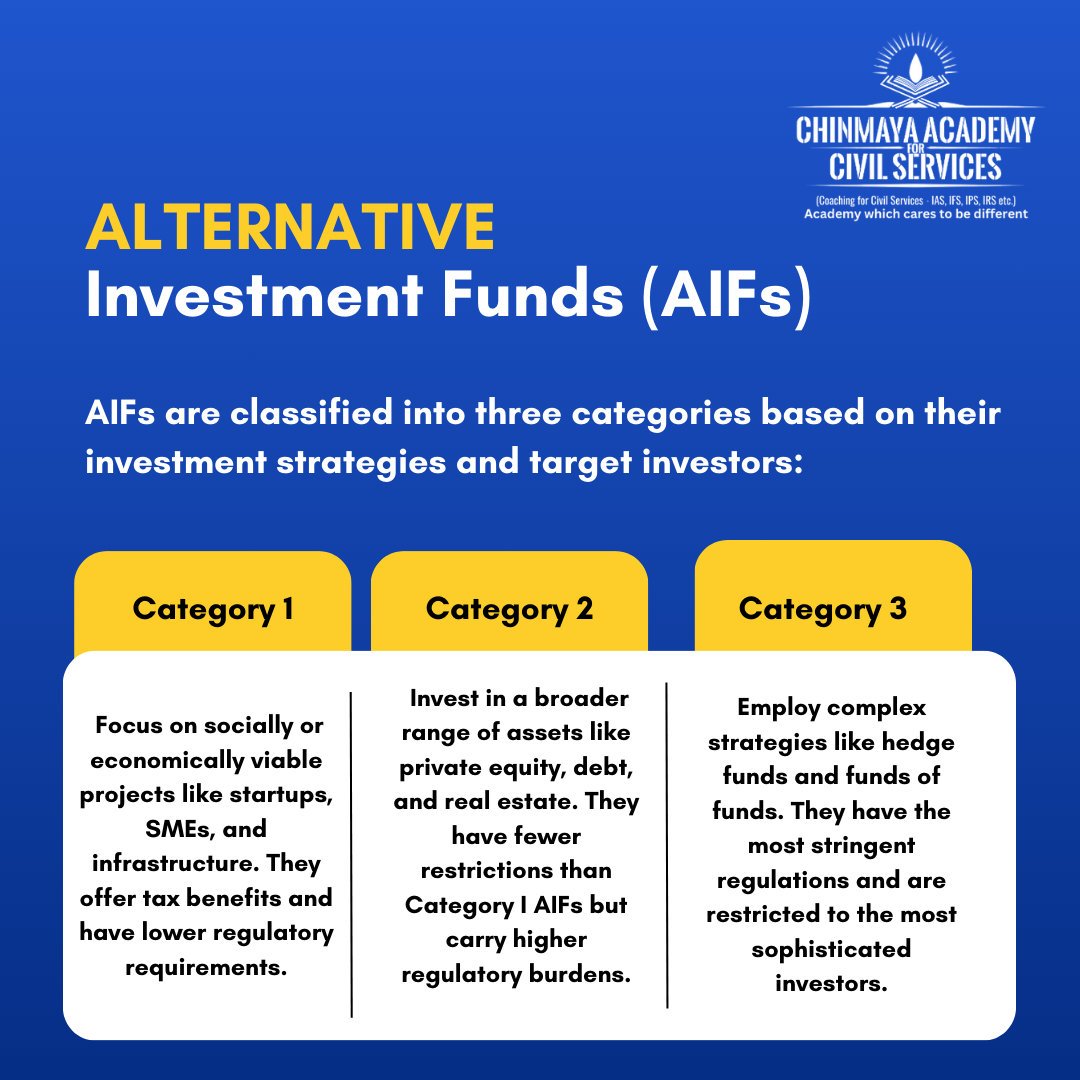

6. Categorization of AIFs:

Remember, AIFs are suitable for sophisticated investors with a high net worth, substantial risk tolerance, and a long-term investment horizon. They are not for everyone.

Benefits of investing

- Access to alternative assets: AIFs provide investors with access to a wider range of assets than traditional mutual funds, which can help diversify their portfolios and potentially improve their returns.

- Higher potential returns: AIFs have the potential to generate higher returns than traditional mutual funds due to their flexible investment strategies and exposure to alternative assets.

- Tax benefits: Certain categories of AIFs, such as Category I AIFs, offer tax benefits to investors.

Risks of investing

- Higher risks: AIFs are generally considered to be riskier than traditional mutual funds due to their exposure to alternative assets and flexible investment strategies.

- Limited liquidity: AIFs may be less liquid than traditional mutual funds, meaning that it may be difficult to sell your investment quickly.

- Higher fees: AIFs typically charge higher fees than traditional mutual funds.

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs