- Sanctions are not hurting Russia, but the war is taking a toll on US and EU economies.

- February 24 marks the one-year anniversary of the Russia-Ukraine war.

- Although it was believed this was going to be a one-sided battle, the US and its allies stepped in with weapons for Ukraine and sanctions against Russia.

- Around $300 billion of Russia’s gold and foreign exchange reserves are frozen by sanctions.

- The embargo on Russian oil by the US and its allies is still in place.

- Russian access to the SWIFT financial transaction processing system has been stopped.

- Multinationals such as McDonald’s, KFC, Adidas, British American Tobacco etc have closed down their operations in Russia.

- People thought Russia would crumble economically.

- After all, the $2 trillion Russian economy is minuscule in comparison to the US and its allies with a combined market size in excess of $30 trillion.

- But the Russians are showing no signs of economically caving in.

Russian economy holding strong

- In fact, there are signs of the Russian economy performing better.

- As per estimates by the IMF, Russia is expected to grow by 2. 1% in 2024, in comparison to 1% for the US, 1. 6% for the Euro area (27 countries), and 0. 9% for Japan.

- The other big economies such as China and India, which have not imposed any sanctions and continue to buy oil from Russia, are expected to grow at 4. 5% and 6. 8%, respectively.

- In fact, companies of Chinese and Indian origins such as ANT group, China Communications Construction Company, JSW Steel, State Bank of India etc, continue to do and expand business in Russia.

- Besides China and India, Russia continues to trade aggressively with countries in Africa and Latin America.

The sanctions by the West seem to have little impact on Russia. - It was therefore no surprise to see the Russian ruble appreciate the most during the month of June last year, hitting 52. 3 to the dollar, strongest since May 2015.

- The annual inflation rate in Russia fell to 11. 9% in December 2022 from 12% in the previous month.

- Inflation is slowing for the eighth consecutive month and reached its lowest since February 2022 when the war started.

Woes for Europe

- Meanwhile, in the Euro region the growth rate is plummeting, jobs are hard to come by, and inflation rates are going through the roof.

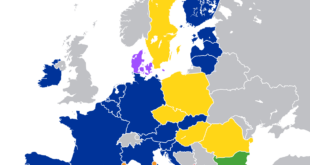

- As of December 2022, inflation rate in the EU region was 10. 4%, with some countries such as Latvia, Lithuania, Hungary, Estonia and Poland witnessing inflation rates in excess of 15%.

- Before the war started, almost 40% of the total energy demand in Europe (especially natural gas) was met by Russia.

- But sanctions have affected the supply of Russian energy.

- And a substitute for this is costlier US energy (both natural gas and gasoline), which means Europe has to shell out more.

- This means an aggravating budget deficit for European governments.

- A higher budget deficit can be sustained only if the economy is growing.

- However, economic growth is continuously falling in the Eurozone.

- Government debt as a percentage of GDP rose from 83. 8% in 2019 to 96. 4% in 2022.

- Higher energy and food prices engendered by the war are likely to push the deficit higher by another 2%.

- Moreover, slower GDP growth, an aging population, war and higher energy prices are making it difficult to increase tax realisation in the Eurozone.

US burning its fingers

- In the US, inflation is showing no signs of retreat. It hit a historic high of 9. 1% in June 2022, the highest recorded during last 40 years.

- It is presently around 6. 5%, this is much higher than the Fed target of 2%.

- And this is in spite of repeated rate hikes.

- The higher allocation of money to the defence sector and expenditure on the Ukraine war mean the US government is spending too fast without any commensurate increase in economic output.

- For fiscal 2023, the defence budget has been increased to $857 billion, which constitutes more than a third of the total budget.

- Meanwhile, rate hikes and inflation in the US and Europe have led to a fall in real wages.

- This has led to an increase in labour agitations – train workers in France and the UK, energy sector workers in Norway, and aviation workers in various budget airlines in the US.

- Tightening monetary policy and continuation of the war are going to see many more such labour agitations.

- Russia can survive this war economically thanks to China and India.

- What seems to be a zero-sum game for Europe is proving to be a positive-sum game for Russia, China and India.

- What seems to be a war of ideology – democracy versus autocracy – is proving to be an expensive proposition for Western allies.

SOURCE: THE TIMES OF INDIA, THE INDIAN EXPRESS

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs

Chinmaya IAS Academy – Current Affairs Chinmaya IAS Academy – Current Affairs